Rising Inflation Rates Take a Toll on the SCCC Community

Inflation is at the highest it’s been in 40 years at 7.9%. This rapid increase has affected Americans’ wallets and financial stability, including SCCC students and faculty.

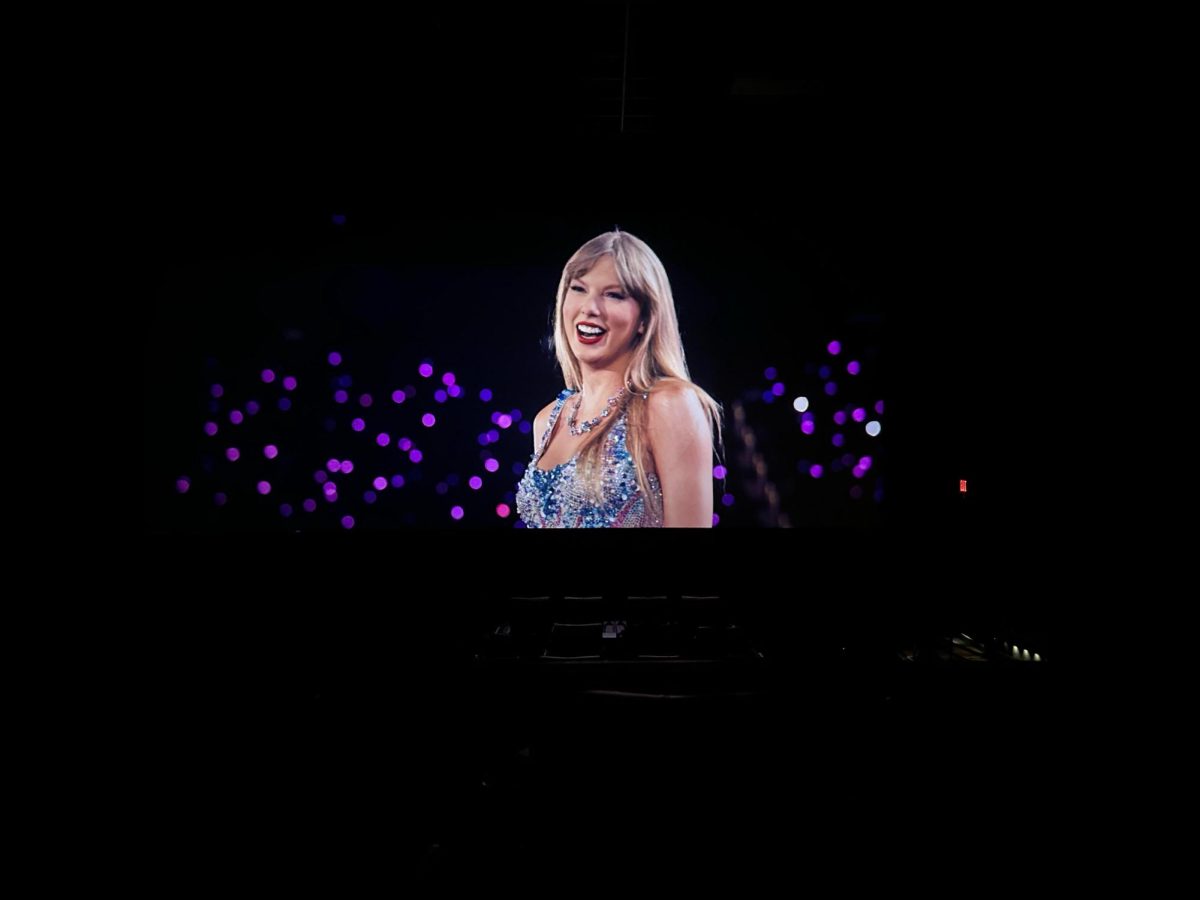

At this gas station in Babylon, gas prices were listed at $4.39 per gallon on March 31, 2022. Gas prices on Long Island have risen 55 cents since the beginning of March.

April 10, 2022

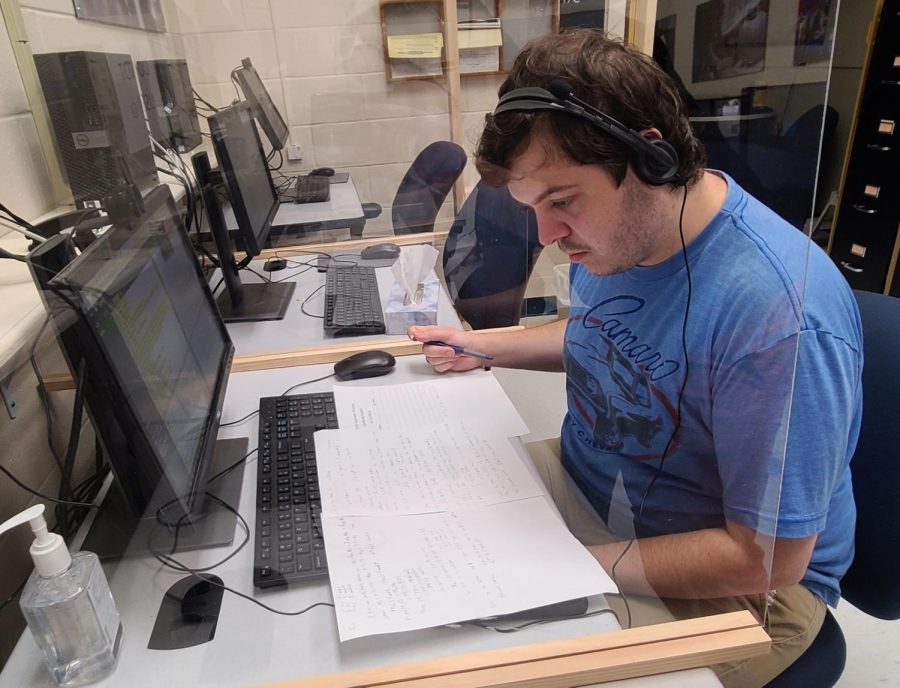

Derek Elkins, a 28-year-old computer science major at SCCC, pulled up to the Shell gas station on the corner of Route 112 to fill up the tank of his truck. It was a Monday morning and his first class of the day started in 30 minutes. With the morning grogginess lingering, he didn’t pay too much attention to the neon sign that listed the gas prices, that is until he went to pay inside at the cash register.

“I had just filled my tank up for $3.22 a gallon last time, so when I found out inside that they were at $4.19 I thought, “This has to be a joke,” Elkins said. “I asked the guy inside what the hell happened to the gas prices and he told me they were competitive pricing with other gas stations.”

This experience is almost universal among the majority of Americans, including our own SCCC community, due to multiple exacerbating factors. That includes higher gas prices, which are due in part to the U.S. ban on imports of Russian oil after the Russian invasion of Ukraine.

Gas isn’t the only commodity that has risen in price, though. The USDA has predicted food costs, in grocery stores, to rise an additional 3-4% in 2022. This is not taking into consideration that inflation is the highest it’s been since the beginning of 1982.

In fact, annual inflation rates have doubled in the past four years. In March 2018, inflation rates were at 2.2% while in the same month of 2022, inflation rates hit a high of 7.9%-the highest it’s been since January 1982.

However, many economists say that the rise in the inflation rate was predicted to happen, not only because of the Russian-Ukraine conflict but because Americans have been re-entering the economy after the Covid lockdown and spending more money.

“We were already on an inflationary track before all of this happened. A large amount of it, economists would say, was because people were going back to work,” said SCCC economist professor Thomas Flesher. “There’s an increase in demand because people are making more money and spending more money. That tends to not only increase the amount we’re producing but also increase the prices that people pay in the short term.”

Gas prices have steadied over the course of the past two weeks, but they still are putting a strain on consumers’ wallets. Although Russia’s crude oil and petroleum imports only provide 2% of all of the United States oil supply, the ban is still a large factor in rising prices.

“One of the biggest issues we’re starting to see with the conflict in Ukraine is that Russia is a big producer of oil and petroleum products,” Flesher said. “Lukoil, for example, is a Russian-owned property, there are municipalities in New Jersey and other companies that are boycotting Russian oil and it is costly to get those products out of Russia. This is also a factor in rising prices.”

The pressure on Americans to accommodate increasing prices for basic necessities such as gas and food has taken its toll on communities and families. Our own SCCC community has also felt the repercussions.

“I told the clerk at the gas station that I really didn’t want to pay such a high price,” Elkins said. “He told me that nobody wants to pay for it, but that’s how it is. At that point, I just had to eat it. I didn’t really have a choice”

However, some students drive eco-friendly vehicles that have good gas mileage and smaller tanks.

Peter Scalabrino, a 19-year-old economics major at SCCC, drives a Honda Civic that averages 36 miles per gallon. This means he hasn’t been hit as hard by these increasing gas prices.

“I used to pay 20 dollars every time when gas was low but now I pay 25. So it’s not too much but I still have to pay five dollars more,” Scalabrino said.

Flesher said there are ways to save money in times of economic strife — mainly by budgeting and being a smart consumer.

“You want to buy your gas early in the morning, if at all possible, when it’s coolest during the day,” Flesher said. “We essentially wanna look for any inefficiencies and loopholes such as carpooling. We’d also advise taking advantage of what’s on campus and doing less non-essential travel.”