Banking Failure Crisis: Should People be Alarmed?

April 3, 2023

After the bank failures of Silicon Valley Bank and Signature Bank, fear and confusion about what this means for the economy have spread. Why are these two bank runs monumental and how will it affect banking going forward?

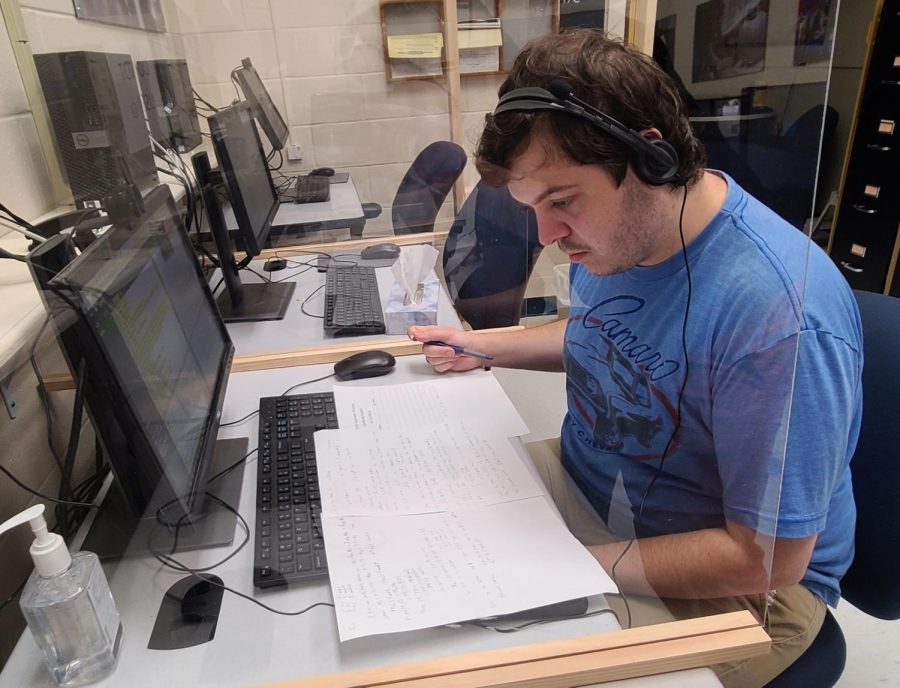

“I think it is insane that this happened in the first place … Two banks failing that easily,” said Nick Doyle, a psychology major from Smithtown.

On March 10, the Federal Deposit Insurance Corp. took over the Silicon Valley Bank after earlier that week depositors began to take out their money all at once; causing a bank run. Following the hysteria, on March 12, Signature Bank depositors fell victim to the same fate, resulting in the FDIC needing to take control again.

“The FDIC covers $250,000 per depositor, if it is over $250,000 you will only be covered up to that amount and whatever the bank sells in assets will be covered in priority order,” said Thomas Flesher, a Suffolk County Community College economics professor. “The big deal is that the two banks that failed are used by a lot of businesses for companies’ payrolls and paychecks.

Employees whose companies use these banks could have been at risk of not getting paid on the schedule they usually are. Putting into perspective why some of these companies felt the urgency to withdraw their money as quickly as possible. However, in a March 13 press release, the FDIC stated that all the depositors of the Silicon Valley Bank would have full access to their money.

“The main fear is that these bank runs may happen to others,” said Flesher.

The Signature Bank and Silicon Valley Bank runs being the most substantial bank failures since the 2008 financial crisis puts many at unease and wonder as to how this may affect the greater public.

On March 26, the FDIC announced that North Carolina-based First Citizens will buy Silicon Valley Bank. Customers of SVB automatically will become customers of First Citizens.

Investors are the ones that will be the most affected as the markets recuperate from the effects of the bank failures.

“A checking account is not an investment vehicle,” Flesher said. “You can do well with meme stocks but you can lose everything. If you can get rich quickly, you can get poor quickly.”

Riley Zalbert • Apr 3, 2023 at 11:45 am

Was so scared there would be a bank run before I saw the specifics that it was only really affecting the banks that deal with crypto